The performance of stock trading bots’ strategies has always been a focal point for investors and traders, with various strategies achieving outstanding results despite market volatility. One of the most notable strategies in recent months is the Sigma Series, which has vastly impressed many StockHero users.

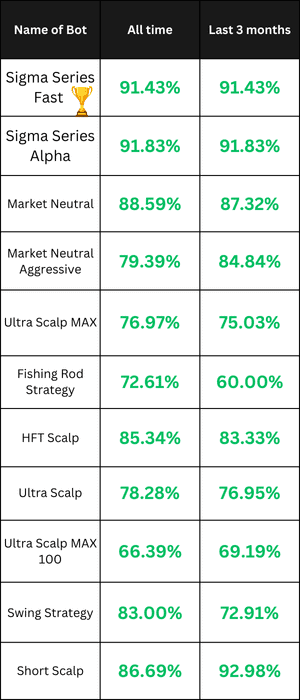

We are especially pleased to announce that the Sigma Series stock trading bot has achieved a record-breaking win rate of about 91.6%. Its effectiveness has been particularly evident in volatile periods, such as the early August market crash and the fluctuations seen in September. Despite market uncertainties, Sigma Series strategy has demonstrated resilience and the ability to adapt, allowing it to become a go-to strategy for traders seeking a well-performing stock trading bot.

Listed in July, the Sigma Series rapidly grew in prominence. The stock market, often subject to unpredictable swings, found in Sigma a strategy capable of navigating turbulence while maintaining its high win rate. The August market crash (which many attributed to the unwinding of the yen-carry trade), which sent shockwaves through various sectors, did not deter Sigma’s performance. Instead, it proved to be a litmus test that highlighted the robustness of the trading strategy in handling extreme conditions. September’s volatility was another hurdle, but Sigma Series strategy emerged unscathed, further reinforcing its reputation as one of the most reliable stock trading bots available today.

Prior to Sigma’s dominance, the Market Neutral strategy was considered one of the top-performing approaches. Known for winning the prestigious Best Bot Award for two consecutive years, this strategy has consistently maintained a near 90% win rate since its inception in October 2022. While it has recently been surpassed by Sigma in terms of overall performance, Market Neutral continues to be a strong contender, offering a balanced approach to trading that appeals to many investors.

Check out the performance data below.

Another variant, the Market Neutral Aggressive strategy, has shown improved performance in recent times, likely due to its ability to capitalize on market fluctuations more assertively. Although its win rate hasn’t yet surpassed Sigma’s, its performance has improved, making it a notable strategy for those seeking higher-risk, higher-reward opportunities.

Among all strategies, the Short Scalp strategy has emerged as particularly impressive. With a staggering 92% win rate, this high-frequency trading approach has made waves by executing rapid trades in short market intervals. Its exceptional performance in a volatile market underscores its potential for those seeking quick profits.

Each of these strategies offers unique advantages, but in the current trading landscape, the Sigma Series strategy stands out as a record-breaking force.

Check out the last blog on Stock Trading Bots’ Performance Data >>