In the dynamic realm of financial markets, stock traders employ various strategies to capitalize on price movements. Among these, swing trading and scalp trading stand out as popular techniques, each with distinct characteristics and objectives.

Swing Trading

Swing trading is a medium-term trading approach that aims to capture price swings within a given trend. Traders typically hold positions for days, weeks, or even months, aiming to profit from price fluctuations occurring within broader market movements. This strategy relies on technical analysis, focusing on indicators like moving averages and oscillators to identify potential entry and exit points.

The core principle of swing trading is to ride the waves of market sentiment, capitalizing on price corrections or trend reversals. Traders often look for opportunities in stocks, currencies, or commodities displaying clear patterns or well-defined support and resistance levels.

One of the key advantages of swing trading lies in its flexibility. Traders do not need to monitor the markets constantly, making it accessible to those with busy schedules. However, it requires a solid understanding of technical analysis and the ability to weather short-term market volatility.

Scalp Trading

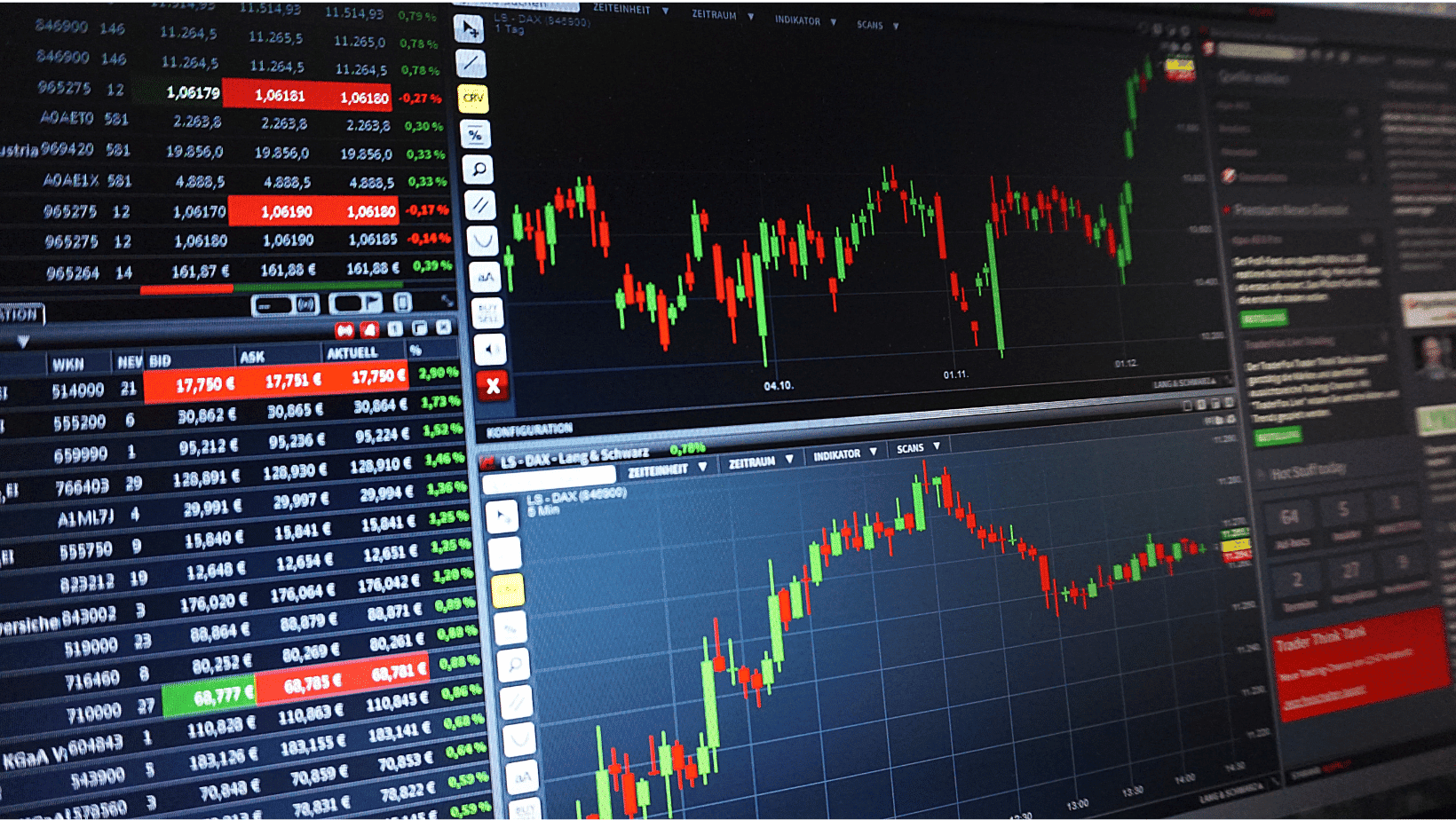

In contrast, scalp trading is a high-speed, short-term strategy focused on profiting from tiny price movements. Scalpers enter and exit positions within days or even minutes, aiming to accumulate small gains over numerous trades. This technique relies heavily on technical indicators, highly efficient quotes, and real-time market data. Most importantly, scalpers trade using no more than 5 minutes trading frequency for scalp strategies.

Did you know? StockHero offers up to 1 minute trading frequency for the most demanding scalp traders!

Scalp traders often operate in highly liquid markets, such as Forex or heavily traded stocks, where price fluctuations occur frequently. They seek to exploit bid-ask spreads and market inefficiencies, requiring swift execution and impeccable timing.

The primary advantage of scalp trading is its potential for rapid, albeit small, profits. However, it demands an exceptional level of discipline, keen analytical skills, and a robust risk management strategy to mitigate potential losses.

Scalp traders often rely on stock trading bots to help them monitor their collection of stocks. It would be humanly impossible to read and evaluate real time data for dozens of stocks.

In conclusion, while both swing trading and scalp trading aim to profit from market movements, they differ fundamentally in their time frames, risk tolerance, and analytical approaches. Swing trading embraces a more patient, medium-term perspective, while scalp trading thrives on precision and speed, capitalizing on micro-movements in the market.